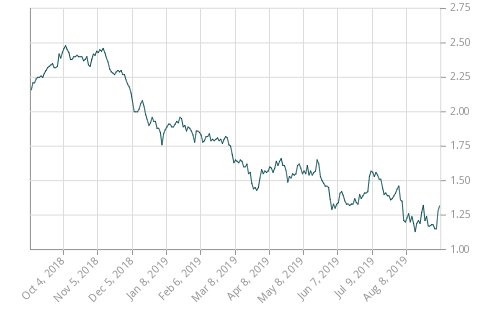

Bank Of Canada Interest Rate History Chart

In the long term the canada chartered banks prime lending rate is projected to trend around 345 percent in 2021 and 395 percent in 2022 according to our econometric models.

Bank of canada interest rate history chart. This is lower than the long term average of 286. Treasury bonds libor rates and much more. Following is a brief history of the key rate from the banks founding in 1935 until the present. The bank of canada is the nations central bank.

We are not a commercial bank and do not offer banking services to the public. 30 year fixed mortgage rate historical chart. Rates presented are the most typical of those offered by the six major chartered banks. Federal funds rate 62 year historical chart shows the daily level of the federal funds rate back to 1954.

The bank of canada is the nations central bank. March 1935 to november 1956 the original key interest rate was the bank rate. Rather we have responsibilities for canadas monetary policy bank notes financial system and funds management. Our principal role as defined in the bank of canada act is to promote the economic and financial welfare of canadaquot.

Federal funds rate historical chart. 1 month libor rate historical chart. A series of current and historical charts tracking bond yields and interest rates. Rather we have responsibilities for canadas monetary policy bank notes financial system and funds management.

Over the years the bank of canada has adjusted the way it sets its key interest rate. This is the minimum rate of interest. Looking forward we estimate bank lending rate in canada to stand at 345 in 12 months time. Looking forward we estimate interest rate in canada to stand at 025 in 12 months time.

We are not a commercial bank and do not offer banking services to the public. Weekly posted interest rates covering prime rate conventional mortgages guaranteed investment certificates personal daily interest savings and non chequable savings deposits offered by chartered banks. Our principal role as defined in the bank of canada act is to promote the economic and financial welfare of canadaquot. In the long term the canada interest rate is projected to trend around 075 percent in 2021 and 125 percent in 2022 according to our econometric models.

The fed funds rate is the interest rate at which depository institutions banks and credit unions lend reserve balances to other depository institutions overnight on an uncollateralized basis.